Total Inventory Cost Formula

Total cost of inventory 1000 x 12 1500 x 15 34500. At the end of the accounting period the company had 500 units left meaning it sold 1500 units.

Supply Chain Inventory Management Chapter 9 Copyright 2013

That cost which do not change with the change in the level of production.

. Total Variable Cost Direct Labor Cost Cost of Raw Material Variable Manufacturing Overhead. Since the units are valued at the average cost the value of the seven units sold at the average unit cost of goods available and the balance of 3 units which are the ending Inventory cost is as follows. When choosing among alternatives in a purchasing decision buyers should.

Multiply the result by 365. Beginning inventory net purchases or new inventory - ending inventory COGS. What is Direct Labor.

Cp Cost to place a single order. Total food sales. Using Weighted Average Cost Ending Inventory Formula.

Total inventory turnover is calculated as. Some examples of the fixed cost of production are selling expense rent expense. 8150000 Cost of Goods Sold 1630000 Inventory 5 Turns Per Year.

Beginning Inventory Added Purchases Ending Inventory Total Direct Materials Costs. Theres no formula needed to calculate direct labor. Direct labor is simply the costs associated with paying people to create the product.

Definition Average total assets are the assets used by businesses throughout the accounting period. This figure is mostly used in calculating the activity ratio where revenue generated by the business is compared with the total assets implied. Let us understand how to calculate the total landed cost of a particular shipment.

Ch Cost to hold one unit inventory for a year. These assets are calculated with the opening and closing of the total assets in the businesss balance sheet. Calculate actual food cost for the week using the following food cost formula.

Weighted Average Inventory Example. Average Cost per unit 3810 380 per unit 3 units 380 per unit 1140. Total Cost 20000 6 3000.

The formula for total cost can be derived by using the following five steps. To calculate your food cost percentage first add the value of your beginning inventory and your purchases and subtract the value of your ending inventory from the total. Terms Similar to.

Heres what this formula looks like in practice. Relevance and Use of Total Variable Cost Formula. Ending Inventory 16000.

Jenny owns a grocery store where she has 2000 in. In 2020 factory X manufactured 1600 pieces and sold 900 pieces. To calculate the cost of goods sold use the following formula.

Check out the example below to see this food cost percentage formula in action. Heres a formula to calculate your total direct materials costs. Firstly determine the cost of production which is fixed in nature ie.

The first set of units purchased cost 10000 1000 x 10 and the second set of units purchased cost a total of 15000 1000 x 15 for a total of 2000 units and 25000 spent on new inventory. Determining whether your DIO is high or low depends on the average for your industry your business model the types of products you sell etc. I t starts with determining the essential components that make up the Total Landed Cost.

Starting with the basics and then adding on the minute details in the formula are the way to go. Finally the formula for total variable cost can be derived by adding direct labor cost step 1 cost of raw material step 2 and variable manufacturing overhead step 3 as shown below. The cost incurred to handle and store the inventory generally ranges between 15-40 of total inventory cost which further includes the costs attributable to storage and material handling charges the financing cost the opportunity cost of holding inventories and.

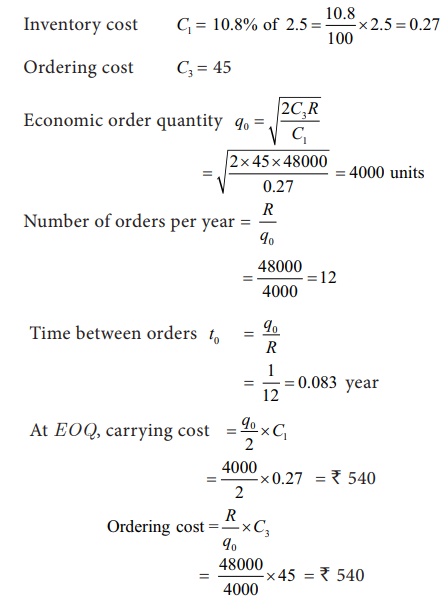

During the month ABC has the following transaction. Total Relevant Cost TRC Yearly Holding Cost Yearly Ordering Cost Relevant because they are affected by the order quantity Q. The related information is 8150000 of cost of goods sold in the past year and ending inventory of 1630000.

The inventory holding cost can be calculated as. Total Cost 38000 Explanation. Your business has 10000 in inventory at the start of the year You buy 9000 in new products during the year.

Total Cost Of Ownership - TCO. Lets see an example of the days in inventory formula. To help you understand more and apply this formula we take an example of a textile company X producing silk.

For example ABC is a retail company that purchases cloth from oversea and sell to the local customer. Previous finished goods inventory value. It includes cost price of the product paid to the supplier freight costs.

1 piece of silk cost 5 each to fabricate. Inventory Management Models. Food Cost Percentage Beginning Inventory Purchases Ending Inventory Food Sales.

Beginning Inventory 15000. At the end of 2020 factory X had 1000 finished pieces of silk in stock that needed to be sold. Economic Order Quantity EOQ EOQ Formula.

Divide cost of average inventory by cost of goods sold. Food cost percentage formula. Total cost of ownership TCO is the purchase price of an asset plus the costs of operation.

The 5 turns figure is then divided into 365 days to arrive at 73 days of inventory on hand. The dollar value of your sales for the week which you can find in your sales reports.

Inventory Formula Inventory Calculator Excel Template

Chapter 12 Independent Demand Inventory Management Operations Management

Chapter 12 Independent Demand Inventory Management Prezentaciya Na Slide Share Ru

Economic Order Quantity Eoq Applications Of Differentiation Maxima And Minima

Comments

Post a Comment